Bitcoin, Ethereum and Crypto Market Indexes – A Bear Market with a Different Pulse

By [Your Name]

June 2024 – Cointelegraph

Overview

The cryptocurrency sector is navigating a sizeable correction that has erased roughly 44 % of its market cap since the October 2023 peak of $4.4 trillion. While Bitcoin and Ethereum have both slid further into bear‑land, industry insiders argue that the current downturn differs fundamentally from previous cycles that were punctuated by high‑profile institutional collapses such as FTX. The growth of tokenized real‑world assets (RWA) and a surge in on‑chain perpetual contracts are highlighted as the main forces reshaping the landscape.

Price Snapshots

| Asset | Approx. price (June 2024) | % change YTD* |

|---|---|---|

| Bitcoin (BTC) | ~ $26,500 | – 38 % |

| Ethereum (ETH) | ~ $1,650 | – 35 % |

| Chainlink (LINK) | < $9 | – 67 % since Oct 2023; – 83 % from its 2021 high |

*Percentages are based on data from the leading crypto price indexes and reflect the ongoing correction that began in late 2023.

Both BTC and ETH continue to trade well below their all‑time highs, confirming a broad‑based sell‑off across the market. However, according to analysts, the price decline is largely a “crisis of confidence” rather than a fallout from systemic failures.

Why This Bear Market Is Different

1. Absence of Major Institutional Failures

Sergey Nazarov, co‑founder of Chainlink, points out that the current slide has not been triggered by large‑scale risk‑management breakdowns. Unlike the 2022 turbulence that saw FTX and several crypto‑lending platforms implode, this cycle has unfolded without a comparable institutional collapse. “We have not witnessed any large‑scale risk failures that resulted in widespread systemic risk,” Nazarov wrote on X.

2. Robust Growth of Tokenized Real‑World Assets

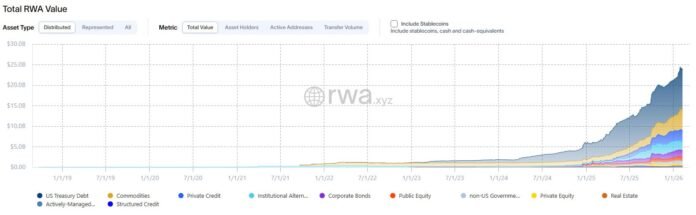

Tokenization of real‑world assets—ranging from commodities to tokenized equities—has continued to increase its on‑chain value despite the price slump in native cryptocurrencies. Data from RWA.xyz shows a 300 % rise in the total on‑chain valuation of tokenized RWAs over the past twelve months. This expansion underscores that the utility of bringing real‑world assets onto blockchain does not hinge directly on the price of Bitcoin or other speculative tokens.

3. On‑Chain Perpetual Contracts and 24/7 Markets

The expansion of on‑chain perpetual contracts for traditional commodities is providing continuous market access, on‑chain collateralisation, and real‑time data feeds. These features are attracting institutional interest that values the intrinsic utility of the infrastructure over pure price appreciation.

Analyst Perspectives

- Bernstein’s Gautam Chhugani describes the present environment as “the weakest Bitcoin bear case in history,” emphasizing that the market is experiencing a confidence shock rather than a fundamental breakdown.

- Jeff Mei, COO of BTSE echoes this view, attributing the sell‑off primarily to non‑crypto catalysts such as concerns over a waning AI‑driven equity rally and anticipated tighter monetary policy under the incoming Federal Reserve chair, Kevin Warsh.

Both analysts suggest that while crypto prices are under pressure, the underlying technology stack—particularly oracles and RWA tokenization—remains on an upward trajectory.

Implications for the Future

Nazarov projects that if current trends persist, tokenized RWAs could outstrip traditional cryptocurrencies in total on‑chain value, fundamentally reshaping the industry’s focus. The demand for sophisticated oracle services and on‑chain infrastructure is expected to rise as complex RWAs require reliable data feeds and cross‑chain interoperability.

For investors, the message is twofold:

- Short‑Term Price Risk Remains High – Bitcoin, Ethereum, and related tokens are still navigating a deep correction with limited upside in the near term.

- Long‑Term Structural Growth Is Likely – The rise of RWA tokenization and perpetual contracts signals a shift toward utility‑driven adoption, potentially providing new revenue streams and institutional entry points even if native token prices stay depressed.

Key Takeaways

- Market Correction: Crypto market cap down ≈ 44 % from its October 2023 peak; BTC and ETH both below $30 k and $2 k respectively.

- No Systemic Failures: Unlike prior bear markets, the current downturn lacks large institutional collapses, indicating a maturing risk‑management environment.

- RWA Momentum: On‑chain value of tokenized real‑world assets surged 300 % YoY, decoupling from cryptocurrency price movements.

- Infrastructure Demand: Growing RWA ecosystems will drive demand for oracles, cross‑chain protocols, and on‑chain data services.

- Investor Outlook: Expect continued price volatility in the short term; focus on projects delivering tangible utility and real‑world asset integration for longer‑term positioning.

Cointelegraph adheres to an independent editorial policy. Readers are encouraged to verify all information and consult multiple sources before making investment decisions.

Source: https://cointelegraph.com/news/chainlink-sergey-nazarov-bear-market-feels-different?utm_source=rss_feed&utm_medium=feed&utm_campaign=rss_partner_inbound