Bitcoin, Ethereum and the Wider Crypto Market: Price Movements, Derivatives Sentiment and Scaling Challenges

By Crypto Desk – February 2026

Market snapshot

- Bitcoin (BTC) reclaimed the $30,600 level on Monday, riding a broader rally in U.S. equity markets that was sparked by a softer‑than‑expected jobs report.

- Ethereum (ETH) broke back above the $2,150 mark, erasing most of the losses from a 43 % dip that saw the altcoin skim $1,750 on Friday.

- The total crypto‑market capitalization is up roughly 7 % week‑over‑week, but ETH’s share of that growth remains muted, lagging the index by about 9 % in 2026.

Both assets are benefiting from renewed optimism in risk‑assets, yet the underlying sentiment among derivatives traders tells a more cautious story.

Derivatives market: Are traders turning bullish?

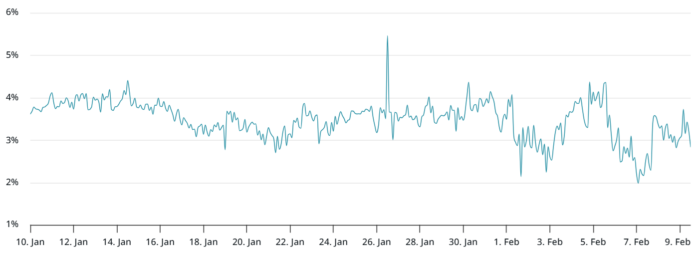

ETH futures continue to trade at a modest premium to spot prices. The 2‑month futures contract posted an annualised premium of roughly 3 %, well under the 5 % level that analysts consider “neutral.” Monthly contracts are in a similar range, suggesting that speculative demand has not yet caught up with the spot rally.

For Bitcoin, the futures curve shows a slightly larger spread—about 4.2 % on the 1‑month contract—still below the neutral threshold. The modest premiums indicate that, while spot prices are buoyed by macro‑driven risk appetite, professional traders remain hesitant to commit larger directional bets.

Key takeaway: The spot price bounce in both BTC and ETH has not translated into a robust bullish stance in the derivatives arena, pointing to lingering risk‑aversion among institutional participants.

Ethereum’s fundamental metrics

Total Value Locked (TVL) and fee generation

Ethereum continues to dominate the decentralized finance (DeFi) ecosystem. Deposit activity on the Ethereum base layer accounts for 58 % of total blockchain‑wide locked value, a share that climbs to over 65 % when the three major layer‑2 networks—Base, Arbitrum and Optimism—are included. By comparison, Solana’s biggest DApp holds just under $2 billion in TVL, while Ethereum’s leading base‑layer application surpasses $23 billion.

In the 30‑day period ending early February, the Ethereum mainnet generated $19 million in fees, ranking third among all blockchains. Layer‑2 solutions added another $14.6 million, highlighting the growing importance of roll‑up ecosystems to the network’s economic activity.

Inflation and supply dynamics

Ethereum’s built‑in burn mechanism—designed to make the token deflationary over time—has faltered as on‑chain demand eases. Over the last month, the net supply of ETH grew at an annualised rate of 0.8 %, a noticeable rise from the near‑zero inflation observed a year earlier. The increase is largely attributed to a slowdown in transaction volume, which reduces the amount of ETH burned per block.

Scaling debates and layer‑2 subsidies

The network’s heavy reliance on optimistic roll‑ups has drawn criticism from co‑founder Vitalik Buterin, who recently argued that the current scaling roadmap needs a “fundamental recalibration.” He pointed out that many layer‑2 bridges are still controlled by multi‑signature wallets, a security model that falls short of the decentralisation ethos of Ethereum. While Buterin acknowledges that layer‑2 solutions will remain crucial—especially for privacy‑focused and application‑specific use‑cases—he stresses that the base layer must improve its own scalability to avoid over‑dependence on subsidised roll‑ups.

Key takeaway: Ethereum’s macro‑level dominance in TVL and fee capture is offset by modest price performance, rising inflation, and an ongoing debate over the sustainability of its layer‑2‑heavy scaling strategy.

Macroeconomic backdrop

The resurgence in U.S. equities—driven by a softer jobs report and renewed optimism around artificial‑intelligence infrastructure spending—has spilled over into crypto markets, lifting BTC and ETH prices. However, uncertainty about the durability of the AI‑driven capital influx and persistent concerns over the U.S. labor market have kept risk‑on appetite tempered. This macro‑environment translates into the muted futures premiums observed across major crypto assets.

Price indexes and broader crypto sentiment

- Crypto Market Cap Index (CMCI): +7 % week‑over‑week; ETH’s weight within the index fell from 17 % to 15 % over the same period.

- Bitcoin Dominance Index: Slightly up, edging from 48 % to 49 % of total market cap, reflecting BTC’s stronger relative rally.

- DeFi TVL Index: +4 % month‑over‑month, driven primarily by Ethereum‑based protocols; Layer‑2 TVL grew at a faster 9 % pace, underscoring the growing relevance of roll‑ups.

Outlook

Short‑term: With spot prices buoyed by a favorable macro climate, both Bitcoin and Ethereum may test higher resistance levels—$31,000 for BTC and $2,250 for ETH—provided that derivatives sentiment does not deteriorate further.

Medium‑term: Ethereum’s price trajectory will likely hinge on two factors: (1) a rebound in on‑chain activity that can revive the burn mechanism and curb inflation, and (2) progress on base‑layer scaling that reduces the network’s reliance on subsidised layer‑2 bridges. A decisive move by the community toward more secure, decentralised roll‑up solutions could restore confidence among risk‑averse traders.

Long‑term: The broader crypto market’s health will remain intertwined with the global risk appetite. Should U.S. equities maintain their rally and AI‑related capital continue to flow, crypto assets could solidify the recent gains. Conversely, any resurgence of macro‑economic headwinds—higher interest rates or a slowdown in AI spending—would likely reinforce the current cautious stance evident in the derivatives markets.

Bottom line

- BTC and ETH have reclaimed modest price gains, but derivatives premiums suggest traders remain on the sidelines.

- Ethereum retains a commanding lead in TVL and fee generation, yet faces criticism over its scaling model and a modest rise in token inflation.

- Macro‑economic optimism is supporting a market‑wide rebound, but underlying risk‑aversion could limit the durability of the rally.

Investors should keep an eye on on‑chain activity metrics, layer‑2 security developments, and the evolution of futures premiums to gauge whether the current price recovery can translate into a sustained upward trend.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Readers should conduct their own research before making any trading or investment decisions.

Source: https://cointelegraph.com/news/eth-taps-dollar2-1k-as-crypto-macro-markets-rebound-is-the-bottom-in?utm_source=rss_feed&utm_medium=feed&utm_campaign=rss_partner_inbound