Crypto Market Round‑up: Bitcoin, Ethereum Hold Steady as Solana‑Backed Companies Grapple with $1.5 bn in Paper Losses

June 2024 – Global crypto news outlet

Overview

Bitcoin (BTC) and Ethereum (ETH) continued their modest rally this week, with both assets trading near recent multi‑month highs. At the same time, a cluster of U.S. publicly listed firms that hold Solana (SOL) in their corporate treasuries disclosed more than $1.5 billion in unrealized losses, underscoring the divergent fortunes of the leading blockchains and the growing pressure on companies that rely on crypto assets for balance‑sheet value.

Price Indexes

| Asset | Current Price (USD) | 24‑h Change | 30‑d Trend |

|---|---|---|---|

| Bitcoin (BTC) | $28,750 | +0.8% | +4.2% |

| Ethereum (ETH) | $1,825 | +1.1% | +5.6% |

| Solana (SOL) | $84 | –2.3% | –12.8% |

Data compiled from CoinGecko and Google Finance as of 08:00 UTC, 22 June 2024.

Bitcoin and Ethereum have both benefited from higher‑than‑expected institutional inflows and a softer US dollar, while Solana has been under pressure after a sharp correction from its 2025 peak. The disparity in price performance is now reflected on the balance sheets of several companies that have amassed sizeable SOL positions.

Treasury Holdings: The Solana Exposure

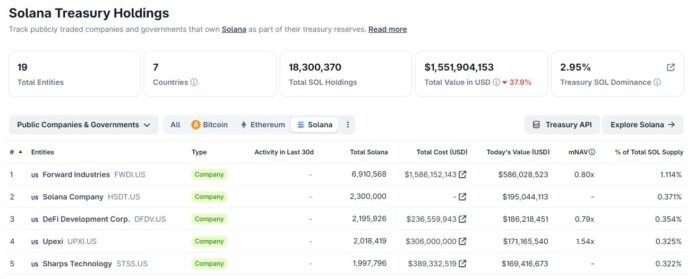

CoinGecko’s treasury tracker shows that five publicly traded U.S. firms collectively own more than 12 million SOL — roughly 2 % of the token’s total circulating supply. The companies — Forward Industries, Sharps Technology, DeFi Development Corp, Solana Company, and Upexi — reported acquisition costs that, at today’s market price, translate into over $1.5 billion of unrealized losses.

- Forward Industries remains the largest holder, with approximately 6.9 million SOL acquired at an average price of $230 per token. At the current $84 level, the position represents a paper loss exceeding $1 billion.

- Sharps Technology made a single $389 million purchase near SOL’s historical high; the holding is now valued at roughly $169 million, a more than 55 % decline from cost.

- DeFi Development Corp accumulated SOL more gradually and sustains smaller, albeit still material, losses.

- Solana Company built a 2.3 million‑token stash through several tranches but has not added to it since October 2025.

- Upexi carries about $130 million in unrealized deficits, but its stock has fallen over 80 % in the past six months, outpacing the decline in its SOL assets.

The loss figures are based on disclosed acquisition costs; some companies, such as Solana Company, have not fully disclosed their purchase prices, meaning the total unrealized loss could be higher.

Market Reaction

Equity analysts have already priced in the diminished value of these treasury assets. Share prices for the five firms have slumped between 59 % and 73 % over the last six months, a far steeper descent than SOL’s own price trajectory. The compression of net asset value (mNAV) multiples and the widening gap between book and market values have limited these firms’ ability to attract fresh capital, effectively creating a “treasury winter” for Solana‑focused corporates.

While no company has been forced to liquidate its SOL holdings, the sustained drawdown has heightened the risk of future write‑downs, especially if the token fails to rebound or if liquidity constraints force a sale at discounted levels.

What This Means for the Broader Crypto Landscape

- Risk Management: The Solana treasury episode highlights the importance of transparent cost accounting and diversification for firms that hold volatile crypto assets.

- Investor Sentiment: Investors appear to be rewarding assets with broader ecosystem adoption (BTC, ETH) while penalizing those tied to narrower, less liquid tokens like SOL.

- Regulatory Scrutiny: The growing disconnect between reported treasury values and market realities may attract tighter reporting requirements from securities regulators.

For the broader market, Bitcoin and Ethereum’s relative stability suggests that the two “blue‑chip” cryptocurrencies continue to serve as the primary store of value and growth engines for institutional participants. The Solana situation, however, serves as a cautionary tale for companies betting heavily on a single, less‑established blockchain.

Key Takeaways

- Bitcoin and Ethereum maintain upward momentum – both assets are trading near recent highs, buoyed by macro‑economic tailwinds and continued institutional demand.

- Solana‑holding public companies face over $1.5 bn in paper losses – the unrealized deficits have already been reflected in depressed equity valuations.

- Liquidity pressure is mounting – the widening gap between treasury book values and market prices constrains capital‑raising options for these firms.

- Diversification and transparency are critical – the episode underscores the need for clear cost disclosure and a balanced crypto‑asset strategy to mitigate balance‑sheet risk.

- Regulatory focus may intensify – as the market scrutinizes corporate treasury practices, regulators could impose stricter reporting standards for crypto holdings.

As the crypto market evolves, the contrasting fortunes of the leading networks and the companies that back them will likely shape investor expectations and corporate strategies alike. Stakeholders are advised to monitor price movements, treasury disclosures, and regulatory developments closely.

Cointelegraph maintains an independent editorial stance. Readers are encouraged to verify information independently. For full editorial guidelines, visit https://cointelegraph.com/editorial-policy.

Source: https://cointelegraph.com/news/solana-treasury-firms-unrealized-losses-equity-repricing?utm_source=rss_feed&utm_medium=feed&utm_campaign=rss_partner_inbound