Bitcoin Bounces Above $71,000 as Fear Index Hits Record Low; Ethereum Holds Near $5,200

February 10, 2026 – CoinTelegraph

Bitcoin (BTC) reclaimed the $71 k threshold on Monday, a movement that follows a week of extreme market pessimism. The Crypto Fear & Greed Index, a widely‑watched sentiment gauge, slipped to a historic low of 7, indicating “extreme fear.” At the same time, Ethereum (ETH) traded relatively flat around $5,200, while several technical and derivatives indicators point to both upside potential and lingering downside risks for the broader crypto market.

Key Takeaways

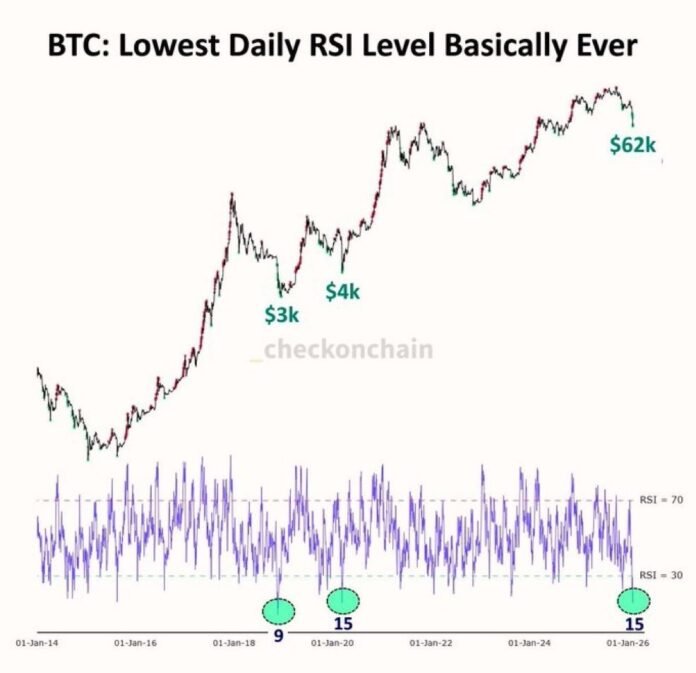

- Sentiment: The Fear & Greed Index dropped to 7, the lowest reading ever recorded, while Bitcoin’s 24‑hour RSI fell to 15, suggesting the asset is deeply oversold.

- Liquidations: More than $5.5 bn of short positions sit ready to be forced out if Bitcoin climbs roughly $10 k, whereas liquidations tied to a $60 k retest amount to $2.4 bn.

- Technical Structure: BTC remains below its 50‑day moving average (~$87 k) and well beneath the 200‑day average (~$102 k), a gap that historically signals a corrective phase.

- Derivatives Pressure: Net taker volume in futures turned sharply negative (‑$272 m on Sunday), and Binance’s taker buy‑sell ratio slipped below 1, indicating stronger selling pressure than buying.

- Ethereum: ETH’s price stayed in a narrow range, with the 30‑day RSI hovering near 45 and the coin trading just above its 100‑day moving average, hinting at modest stability amid BTC volatility.

Market Sentiment in the “Extreme Fear” Zone

The dramatic slide in the Fear & Greed Index to 7 marks the deepest level of anxiety the crypto market has ever seen. Analysts at MN Capital point out that such sentiment readings have historically coincided with market bottoms. In conjunction with a 24‑hour relative strength index (RSI) of 15 for Bitcoin—a figure that has not been witnessed since the 2018 bear market and the March‑2020 COVID‑19 crash—these metrics suggest that Bitcoin is currently oversold.

Michaël van de Poppe, founder of MN Capital, argued that the combination of ultra‑low fear and a plunging RSI could lay the groundwork for a short‑cover rally, provided that buying pressure can outpace the prevailing sell‑side dynamics.

Liquidation Landscape: A Potential Catalyzer

Data from CoinGlass’s liquidation heatmap highlights a stark imbalance: over $5.45 bn of short contracts are positioned to be liquidated if Bitcoin rises by roughly $10 k, while only $2.4 bn would be triggered by a drop back to $60 k. This asymmetry indicates that a decisive upward move could spark a cascade of forced short covering, potentially accelerating Bitcoin’s climb toward the $80 k region.

Technical Weakness and Structural Gaps

Despite the short‑covering upside, Bitcoin’s price action remains constrained by several technical indicators. CryptoQuant shows that BTC is trading well beneath its 50‑day moving average (≈ $87 k) and even farther from its 200‑day moving average (≈ $102 k). The price Z‑Score stands at –1.6, signalling that the current price sits below its statistical mean and that selling pressure remains entrenched.

Historically, such wide gaps between price and long‑term averages precede extended base‑building phases rather than immediate rebounds. Moreover, the 0.618 Fibonacci retracement level for the current cycle sits near $57 k; a breach below this threshold could expose Bitcoin to deeper corrections toward $42 k, echoing patterns from past bear markets.

Derivatives Market Shedding Light on Downside Risks

Derivatives data further underscores the bearish tilt. Monthly net taker volume turned sharply negative, registering a deficit of $272 m on Sunday. Binance’s taker buy‑sell ratio dropped below the neutral 1.0 mark, indicating that sell orders dominate buy orders across major futures markets. With futures volumes outpacing spot flows, a renewed influx of spot buying would be required to offset this selling pressure and trigger a sustained bullish reversal.

Ethereum’s Relative Stability

While Bitcoin wrestles with sentiment swings and structural weakness, Ethereum has maintained a steadier course. The leading ether‑swap pairs have kept ETH near $5,200, with the coin’s 30‑day RSI edging toward the mid‑40s, a neutral zone that suggests balanced demand. Ethereum’s price remains just above its 100‑day moving average, offering a modest cushion against the turbulence seen in Bitcoin.

The Ether market has also benefited from a comparatively lower concentration of short liquidations. According to data from Deribit, short positions amount to roughly $1.2 bn, significantly less than Bitcoin’s exposure, which may limit the risk of abrupt forced covering events for ETH.

Outlook: Bullish Sparks Amid Persistent Headwinds

The convergence of extreme fear, a heavy short‑liquidation load, and technical undershoot creates a complex picture. On the one hand, the market’s “oversold” status could attract value‑seeking buyers and trigger a short‑cover rally that pushes Bitcoin back toward the $80 k‑$90 k corridor. On the other hand, structural gaps, a negative Z‑Score, and ongoing derivatives selling pressure suggest that any upward move could be modest and vulnerable to reversal.

For Ethereum, the relative lack of extreme sentiment and a more balanced derivatives landscape implies a steadier path, at least in the short term. However, ETH’s price is still closely tied to Bitcoin’s trajectory, meaning that a sustained Bitcoin decline could spill over into ether’s market.

Analysts recommend cautious optimism: Investors should monitor the next 48‑hour window for signs of a decisive break above $71 k and a corresponding reduction in short volumes. Simultaneously, the resilience of Bitcoin’s support at $60 k, the health of spot demand, and the evolution of futures net taker volume will be pivotal in shaping the market’s direction over the coming weeks.

The information above is for educational purposes only and does not constitute investment advice. Readers should conduct their own due diligence before making any trading decisions.

Source: https://cointelegraph.com/news/bitcoin-sentiment-hits-record-low-as-contrarian-investors-say-dollar60k-was-btc-s-bottom?utm_source=rss_feed&utm_medium=feed&utm_campaign=rss_partner_inbound