CZ Defends Buy‑and‑Hold Strategy Amid Growing Backlash From Retail Traders

by [Your Name] – [Date]*

Overview

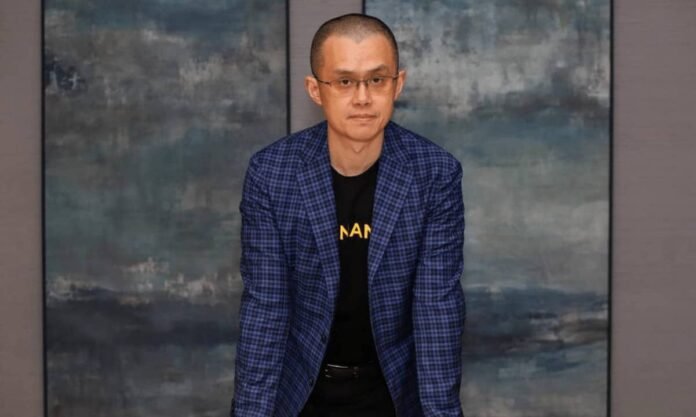

Former Binance CEO Changpeng “CZ” Zhao once again found himself at the center of a heated debate after reiterating his personal “buy‑and‑hold” approach to cryptocurrency investing. Critics on social media accused the Binance co‑founder of encouraging reckless behavior, while Zhao clarified that the advice was meant only as a personal strategy and not a blanket prescription for all tokens. The controversy has reignited broader conversations about market‑risk management, token selection, and the responsibilities of high‑profile figures in the crypto ecosystem.

Timeline of Comments

| Date | Platform | Key Message |

|---|---|---|

| Jan 25 | X (formerly Twitter) | Zhao posted that few trading tactics can consistently outperform a simple buy‑and‑hold approach, emphasizing that the view reflects his own practice and does not constitute financial advice. |

| Jan 28 | X | After backlash, he added that the strategy “obviously does not apply to every coin” and warned that his statements were being twisted by fear, uncertainty, and doubt (FUD). |

| Jan 13 | X | Zhao cautioned traders not to treat his jokes or off‑hand remarks as trading signals, particularly regarding meme coins that tend to generate losses. |

The Core of the Dispute

- Critics’ Argument: Retail traders argued that a blanket endorsement of buy‑and‑hold overlooks the historically high failure rate of crypto projects. Many pointed out that the majority of tokens listed on exchanges never achieve lasting value, and that indiscriminate holding could expose investors to severe losses.

- Zhao’s Rebuttal: The Binance founder stressed the importance of selective investment. He likened the crypto market to early‑stage tech cycles, where a few winners generate outsized returns while most startups falter. Zhao also highlighted that exchanges cannot predict which nascent projects will succeed, and that their role is to provide a “permissionless” environment rather than curate a list of guaranteed winners.

Wider Context

The debate surfaced alongside a resurgence of longstanding accusations against Zhao, ranging from alleged market manipulation to compliance failures that led to a 2023 U.S. plea agreement. Influential traders such as StrongHedge labeled Zhao “crypto’s biggest scammer,” while others defended his contributions to mainstream adoption, pointing to initiatives like user onboarding, the freezing of scam‑related funds, and charitable donations.

These divergent narratives illustrate a persistent tension within the industry:

- Open‑Access Listing vs. Quality Control – Should exchanges list any token that meets minimal technical criteria, or should they impose stricter vetting to protect investors?

- Influencer Responsibility – To what extent should prominent figures be held accountable for the market impact of their statements, even when they explicitly state they are not offering advice?

Analyst Perspective

Risk Management: Zhao’s emphasis on “careful coin selection” aligns with conventional portfolio theory—diversify, but allocate more capital to assets with strong fundamentals and credible teams. The buy‑and‑hold model can work for well‑researched projects, but it is a risky proposition in a market where ≈80% of tokens lose value within three years (according to various on‑chain analytics).

Market Sentiment: High‑profile comments still generate significant price reactions, especially for meme‑style assets that can surge on social media hype. This underscores the need for clearer disclosures when influential individuals discuss trading ideas.

Regulatory Outlook: As regulators worldwide intensify scrutiny on crypto exchanges and market‑making practices, the industry may see more formal guidance on how public figures can communicate investment ideas without crossing into unregistered advisory territory.

Key Takeaways

- Buy‑and‑Hold Is Not Universal – Zhao reaffirms that his personal strategy does not apply to every cryptocurrency; token selection remains crucial.

- Social Media Amplifies Impact – Even non‑advisory remarks from prominent industry leaders can sway retail sentiment, prompting calls for responsible communication.

- Debate Highlights Structural Issues – The controversy reflects deeper questions about listing standards, investor protection, and the balance between open markets and quality controls.

- Regulatory Pressure May Increase – Ongoing legal and compliance challenges faced by Zhao and Binance suggest that future guidance could tighten how crypto influencers discuss investment tactics.

Looking Forward

While the buy‑and‑hold debate may settle into another chapter of crypto’s ongoing discourse, the episode reinforces a fundamental lesson for investors: due diligence and risk assessment cannot be replaced by simple slogans, regardless of the speaker’s stature. As the market matures, both exchanges and thought leaders will likely encounter higher expectations for transparency and prudence.

For further updates on CZ’s statements and market reactions, stay tuned to [Your Publication].

Source: https://cryptopotato.com/cz-says-buy-and-hold-isnt-for-every-token-after-trader-backlash/